Fiscal Times |

At a hearing focused on the state and local tax deduction Tuesday, the “familiar politics of taxation—in which Democrats push to raise taxes on high-income people and Republicans resist—turned topsy-turvy,” writesRichard Rubin of The Wall Street Journal.

During debate in a House Ways and Means subcommittee, Democrats argued that the cap on the SALT deduction imposed by the Tax Cuts and Jobs Act was hurting middle-class families and communities in high-cost parts of the country. Before the law was passed, households could deduct the full cost of their state and local taxes on their federal tax forms, but the TCJA put a $10,000 cap on those deductions, increasing taxes for some residents of high-tax areas. Representatives from those districts are now pushing to restore some or all of the lost tax break.

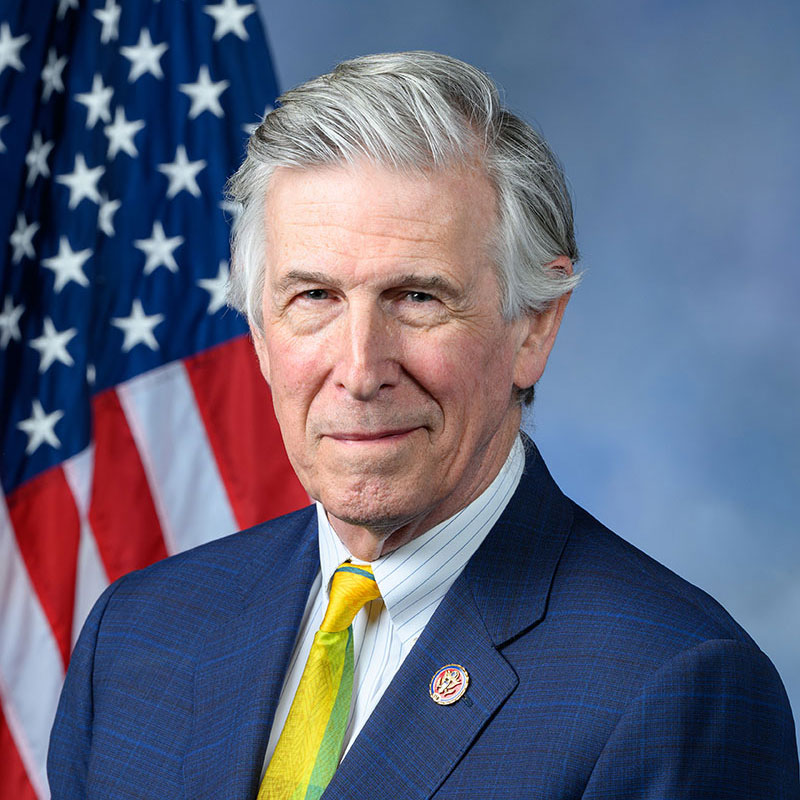

Rep. Don Beyer (D-VA) argued that high-cost areas aren’t necessarily wealthy. A house in an East Coast suburb might cost more than $700,000 and come with a substantial property tax bill, Beyer said, but that doesn’t mean its owners are rich. “There are no yachts in Falls Church,” said Mayor David Tarter, speaking of the wealthy Virginia suburb he helps run.

Click here to read the full article