Press Releases

Beyer: Trump Payroll Tax Move “Treats The Federal Workforce As A Guinea Pig For A Bad Policy”

Washington,

August 28, 2020

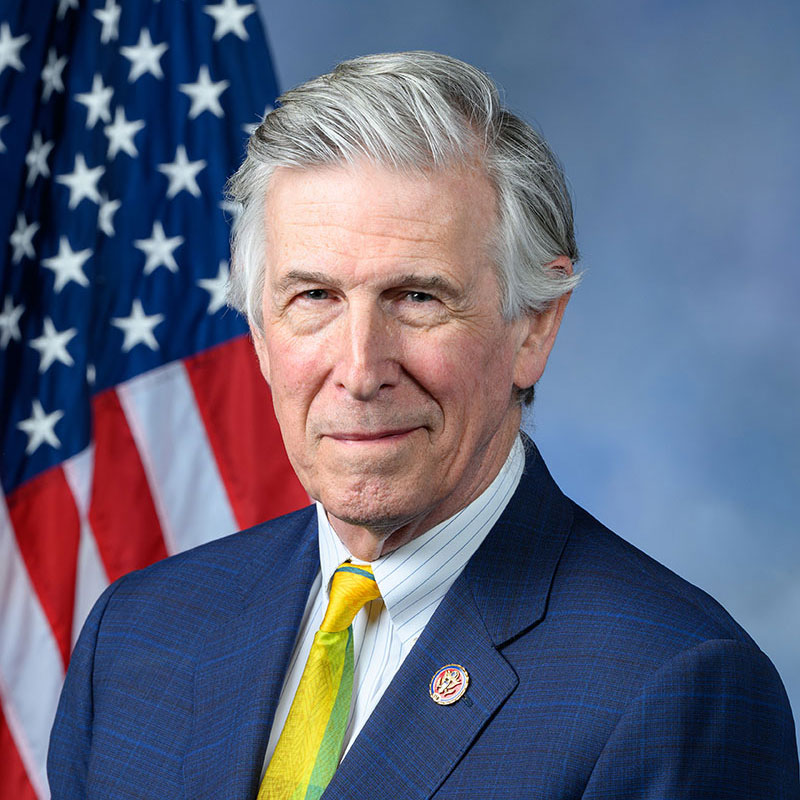

Rep. Don Beyer today blasted the Trump Administration’s announcement that it may soon begin deferring withholding payroll taxes in September for federal employees, a move that could hit thousands with unanticipated large tax bills next year. Beyer, who represents the largest number of federal employees of any U.S. Representative, serves on the House Ways and Means Subcommittee on Select Revenue Measures, which has jurisdiction over tax policy. “The Trump Administration’s plan to initiate payroll tax deferrals for civil servants treats the federal workforce as a guinea pig for a bad policy that businesses already rejected as ‘unworkable,’” said Beyer. “Their proposed payroll tax deferral would not really put money in workers’ pockets, it would simply set up the members of the federal workforce who can least afford it for a big tax bill that many will not expect. Like Donald Trump’s other economic executive orders, this will not provide actual relief to workers, it is just another gimmick intended to give the appearance of action as the White House continues to stall negotiations for a real stimulus package. The rollout of this policy has been abysmal and shows how unserious the administration is about it, but if implemented the deferral will still do more harm than good.” The announcement on payroll tax deferral for federal employees, made in a memo published by the National Finance Center (and later made less clear by a subsequent memo), followed President Trump’s Executive Order “deferring payroll tax obligations” issued on August 8. Business groups previously rejected the order as “unfair” and “unworkable.” The Social Security Administration’s Chief Actuary wrote to members of the Senate earlier this week that the Trump Administration’s plan to defer payroll tax contributions would force Social Security benefit cuts by 2021 and “permanently deplete” a key Social Security trust fund by 2023. |