Articles

Federal workers will have taxes deferred under Trump’s order, sparking outcry they’re being treated as a ‘guinea pig’Few businesses so far have shown interest in adopting Trump’s payroll tax deferral

Washington,

September 2, 2020

Originally published at the Washington Post

Federal workers will have taxes deferred under Trump’s order, sparking outcry they’re being treated as a ‘guinea pig’Few businesses so far have shown interest in adopting Trump’s payroll tax deferralBy Tony Romm and Eric Yoder

September 2, 2020 at 8:24 a.m. EDT

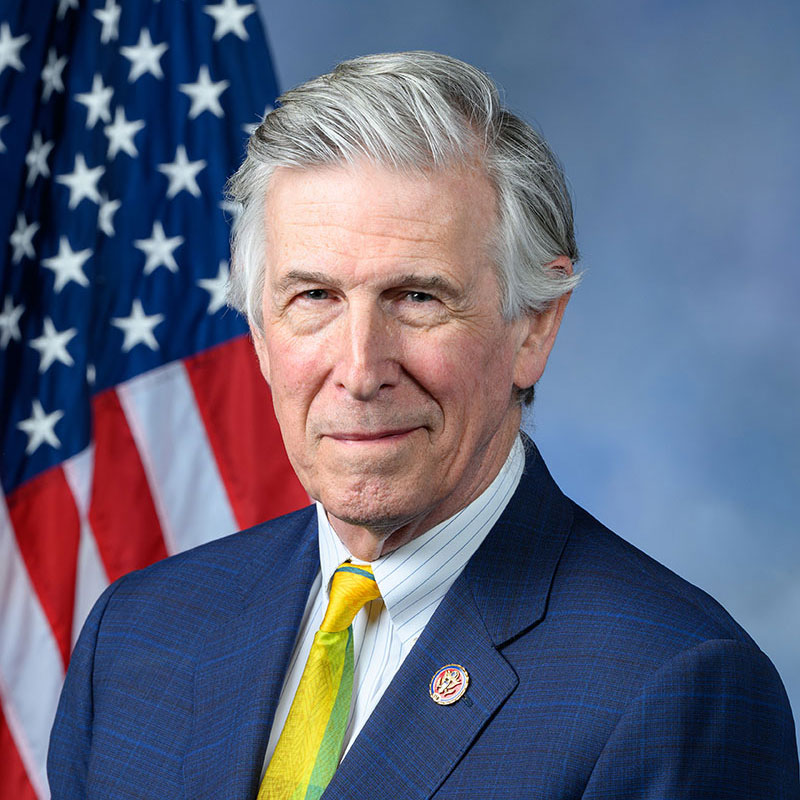

The U.S. government will implement an across-the-board payroll tax deferral for about 1.3 million federal employees starting in mid-September, potentially forcing these workers to take a temporary financial boost now that they will have to repay next year. The policy, confirmed Monday by a senior administration official, comes in response to a widely panned policy directive issued by President Trump earlier in August. Unions have sharply criticized the government’s decision, fearing federal workers may not have a choice in whether to take the deferral — resulting in them receiving smaller paychecks in 2021 until the past-due taxes are paid off. Trump’s order specifically targets the 6.2 percent tax that employers deduct from their workers’ wages so the government can fund Social Security. His directive postpones payment of those taxes until January, at which point employers are required to start collecting back what is owed, perhaps by withholding double the amount they usually take until May. The deferral applies only to people who earn up to $4,000 on a biweekly basis, and less than $104,000 annually. Trump in recent weeks has promised to “terminate” the tax bills Americans rack up during that time, hoping to spare workers from having to repay those debts down the road. But he can’t cut taxes unilaterally, and his pledge has earned virtually no support on Capitol Hill, where lawmakers in both parties have been reluctant to touch the funding source for the country’s cash-starved retirement programs — and are unlikely to do so before potentially millions of workers’ tax bills are due. The idea has proven so problematic that few businesses have expressed any interest in carrying out Trump’s order, even as the government prepares to implement the change for federal employees starting in a few weeks. With so much uncertainty, union leaders unleashed a barrage of criticism on the White House. Everett Kelley, the national president of the American Federation of Government Employees, blasted Trump’s policy on Monday as a “scam that leaves workers with a substantial tax bill right after the holiday season.” “Workers will have to pay double their regular payroll tax rate during the first four months of 2021, and if they cannot do so, they will have to pay interest and penalties on amounts still owed if they’re not paid back by May 1, 2021,” Kelley said. Rachel Semmel, a spokeswoman at the Office of Management and Budget, did not respond to questions Monday about whether the deferral would be optional. “The president put forward this action to give relief to all Americans during this pandemic,” she said in a statement, adding that the executive branch as an employer is “implementing the deferral to give our employees relief as quickly as possible, in line with the presidential memo." The early criticism of the government’s plans highlights the wide-ranging confusion caused by Trump’s order, signed in August in an attempt to circumvent a congressional logjam over coronavirus aid. Lawmakers, tax experts, business leaders and payroll-processing companies have raised concerns about its implementation, raising the potential that Trump’s bid to boost workers’ paychecks may result in little economic gain. It remains unclear, for example, what might happen in the case an employee has his or her taxes deferred and leaves the job before his employer has a chance to collect what is owed. The implications for nonpayment are vast, threatening to widen the financial hole facing Social Security at a time when many budget experts warn that it is in significant need of reform. The Treasury Department and the Internal Revenue Service issued only early guardrails describing the program on Friday, four days before Trump’s directive is set to take effect. That has left few businesses in a position to begin deferring payroll taxes in time for Sept. 1, creating further logistical and technical challenges that make it “less likely” for companies to participate at all, said Pete Isberg, the vice president of government affairs for Automatic Data Processing, known as ADP, which processes payroll for about 670,000 firms. For workers, meanwhile, the concern is that they may lack the means to pay back what they owe. Tony Reardon, the president of the National Treasury Employees Union, said Friday that the roughly 150,000 federal employees he represents may be “unprepared for the higher tax obligation in 2021,” creating particular challenges for IRS workers for whom “overdue tax debt can have severe job consequences.” Most federal agencies use one of four payroll processors, operated by the Defense, Agriculture and Interior departments and the General Services Administration. About 60 percent of the 2.1 million executive-branch employees earn less than $100,000 a year, just below the cutoff set by Trump’s order. Almost all federal employees pay into Social Security on the same terms as other workers; a small percentage are under a retirement system that does not include Social Security. Almost all federal employees are paid on a biweekly pay cycle that ends on a Saturday; the current cycle started Sunday and will end Sept. 12. Most employees receive pay for that period late in the following week or early in the subsequent week. The aim is to implement the deferral starting with the second paycheck in September, the senior administration official said, setting up workers to begin seeing their taxes deferred around Sept. 18. In doing so, Democratic Rep. Don Beyer, whose Northern Virginia district includes a large share of federal employees, faulted the White House for treating federal workers like a “guinea pig” for Trump’s policies. “Their proposed payroll tax deferral would not really put money in workers’ pockets, it would simply set up the members of the federal workforce who can least afford it for a big tax bill that many will not expect,” he said in a statement. |