Press Releases

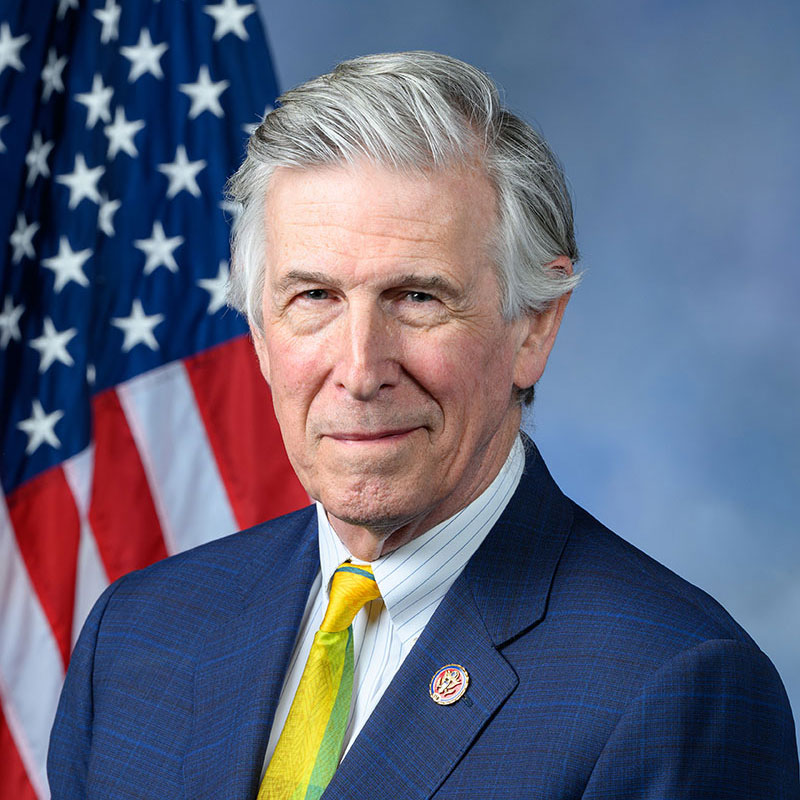

Congressmen Cohen and Beyer Introduce Billionaire Minimum Income Tax ActCongressmen Steve Cohen (TN-09) and Don Beyer (VA-08), after extensive consultation with the White House and Treasury Department officials, today introduced the Billionaire Minimum Income Tax Act, to ensure that the wealthiest Americans pay their fair share in taxes. The bill would enact President Biden’s proposal to require households worth over $100 million to pay at least a 20 percent tax rate on their full income, including unrealized gains. Congressman Cohen made the following statement: “The ultrawealthy pay very low tax rates because their affluence derives primarily from the soaring value of their assets and our current tax code lets billionaires avoid taxes on gains unless and until they sell their assets. So while working families pay taxes on each and every paycheck or pension payment, the ultrawealthy can make hundreds of millions of tax-free dollars a year. Instead of all their billions going to buying superyachts, rocket ships, professional sports teams, and Twitter, it is time that billionaires chip in like everyone else to pay at least a base level of taxes. There is tremendous public support for this proposal, which will close loopholes in our tax code and ensure billionaires pay a fairer share. It’s time to make the tax system fair.” Congressman Beyer made the following statement: “The Billionaires Minimum Income Tax Act is a simple policy to prevent billionaires from paying a lower tax rate than working families. Our bill would impose a minimum tax rate on the wealthiest few with measures to prevent tax avoidance, requiring the super-rich to pay their fair share, reduce inequality, and fund services the American people depend on. Republicans cut taxes for the richest among us while proposing higher taxes on average people. We reject this failed trickle-down economics approach, and are responding with a fair tax policy that will put our country on a stronger fiscal footing while restoring fairness to the tax code.” Congressman Dwight Evans (PA-03) made the following statement: Rep. Dwight Evans (D-PA) said, “As a member of the tax-writing House Ways and Means Committee, I’m proud to co-sponsor President Biden’s Billionaire Minimum Income Tax. I strongly support making sure billionaires pay their fair share in taxes, and the estimated $360 billion in revenue over 10 years could be used for priorities like lowering health care and child care costs for families, fighting climate change, restoring the Child Tax Credit expansion, and fighting gun violence.” Advocates statements: “The President’s Billionaire Minimum Income Tax introduced by Representatives Cohen and Beyer would play a critical role in reforming the tax system, efficiently and fairly raising money from the people who could most afford to pay more. It does this by closing what is effectively a major loophole that allows the wealthiest Americans to choose when and even whether to pay taxes on some of their largest sources of income.” – Jason Furman, Aetna Professor of the Practice of Economic Policy at Harvard University and former Chairman of President Obama’s Council of Economic Advisors “This bill is a big step forward in ensuring that the richest Americans pay their fair share in taxes on their full income.” – Danny Yagan, Former Chief Economist of President Biden’s Office of Management and Budget, and Professor of Economics at the University of California, Berkeley “Making sure billionaires pay their fair share in taxes is our top priority this election season. Constituents and voters want to know whether their elected representatives are standing with them or with 700 billionaires. Congress must end the scandal of billionaires paying a lower tax rate than working families. Congress must create a tax system that taxes income from wealth the same as income from work. Billionaires are literally buying elections. Working Americans feel the system is rigged in their favor. Enacting a Billionaire Minimum Income Tax will start to rebuild trust in our democracy, in our economic system and in our tax code.” – Frank Clemente, executive director, Americans for Tax Fairness “Small businesses pay more in taxes than corporations and billionaires. That's not just wrong, it robs local communities of the investments we need to thrive. Our economy benefits when we all pay our fair share of taxes so we can make needed public investments in child care, health care, and more.” – Chanda Causer, Executive Director, Main Street Alliance “For far too long, the ultra-rich have avoided paying their fair share of taxes thanks to loopholes in how we tax both realized and unrealized capital gains. The Billionaire Minimum Income Tax would root out these unfair advantages at the source and force our nation’s billionaires to pay taxes like everyone else does. It’s completely ridiculous that Americans who work for a living are paying more in taxes than our nation’s billionaires, but this legislation would finally put an end to a shameful status quo. It’s time that Congress got on board with this common-sense tax reform.” – Morris Pearl, Chair of the Patriotic Millionaires and former managing director at BlackRock, Inc. “There is nothing fair about a tax code where billionaires get a free pass, Representatives Cohen’s and Beyer’s Billionaire Minimum Income Tax Act is doing nothing more than asking the people who reap the most to pay their fair share—which they do not do right now. Billionaires generated $2 trillion in new wealth during the pandemic—and slip through loopholes to enjoy it tax-free, while working families pay to keep the schools open and the streets paved. The Billionaire Minimum Income Tax Act would go a long way in creating justice and allow us to thrive in ways we can’t when we’re hobbled by a tax code that is built on inequality.” – Randi Weingarten, President, American Federation of Teachers “It is beyond shameful that billionaires can pay lower tax rates than teachers, nurses and firefighters. This bill will help ensure that the ultra-wealthy begin to pay their fair share. We can and we must fix this broken system.” – Rahna Epting, Executive Director, MoveOn “The Billionaires’ Minimum Income Tax would limit an unfair tax break, raise billions, and be incredibly well targeted. This would dramatically change the game to ensure that the wealthiest Americans are taxed more like the rest of us.” – Amy Hanauer, Executive Director, Institute on Taxation and Economic Policy "Veterans like me and the members of Common Defense who have served our country know what it means to sacrifice for the greater good. Requiring billionaires to pay a minimum tax is hardly a sacrifice, rather it is just that: the least they can do to reinvest in the society which propelled them to such extreme wealth in the first place." – Naveed Shah, Army veteran and Political Director of CommonDefense.us The bill was introduced with 30 original cosponsors, including: Nanette Diaz Barragán, Brendan Boyle, Andre Carson, Yvette Clarke, Danny Davis, Peter DeFazio, Rosa DeLauro, Dwight Evans, Bill Foster, John Garamendi, Chuy Garcia, Jimmy Gomez, Raul Grijalva, Mondaire Jones, Barbara Lee, Betty McCollum, Jim McGovern, Seth Moulton, Jerry Nadler, Marie Newman, Eleanor Holmes Norton, Stacey Plaskett, Katie Porter, Jan Schakowsky, Mark Takano, Rashida Tlaib, Bonnie Watson Coleman, Peter Welch, John Yarmuth. The measure has been endorsed by: AFL-CIO; Alliance for Retired Americans; American Family Voices; American Federation of Government Employees (AFGE); American Federation of State, County & Municipal Employees (AFSCME); American Federation of Teachers (AFT); American-Arab Anti-Discrimination Committee (ADC); Americans for Tax Fairness; Asian Pacific American Labor Alliance, AFL-CIO; Blue Haven Initiative; Center for LGBTQ Economic Advancement & Research; Center for Popular Democracy; Coalition on Human Needs; CommonDefense.us; Communications Workers of America (CWA); Demos; Economic Policy Institute; Friends Committee on National Legislation; Friends of the Earth U.S.; Greenpeace USA; Groundwork Action; Healthcare for America Now (HCAN); Indivisible; Institute for Policy Studies -Program on Inequality; Institute on Taxation and Economic Policy (ITEP); International Brotherhood of Teamsters; International Federation of Professional and Technical Engineers (IFPTE); Islamic Circle of North America Council for Social Justice; Main Street Alliance; MoveOn; National Education Association (NEA); National Employment Law Project; National Women's Law Center; NETWORK Lobby for Catholic Social Justice; Other98; Our Revolution; Oxfam America; Patriotic Millionaires; People's Action; Progressive Change Campaign Committee; Prosperity Now; Public Citizen; Responsible Wealth; RESULTS; RootsAction.org; Service Employees International Union (SEIU); Sojourners; Strong Economy for All; Tax Justice Network USA; Tax the Ultra-Rich NOW!; UltraViolet; United Church of Christ Justice and Local Church Ministries; United for a Fair Economy; Unrig Our Economy; Voices For Progress; Working America. The congressional fact sheet is available here. The section-by-section summary is available here. The full text of the legislation is available here. The White House fact sheet is available here. The Biden Administration’s FY23 Revenue Proposals are available here. |