Press Releases

Wyden, Beyer Call on DOJ to Crack Down on Swiss Banks Enabling Tax Evasion, Prosecute Bankers InvolvedFollowing the Finance Committee’s Two-Year Investigation that Uncovered Ongoing Tax Evasion Enabled by Credit Suisse, Finance Chair and Former Ambassador to Switzerland Urge Attorney General Garland to Act

Washington,

May 18, 2023

Tags:

Economy

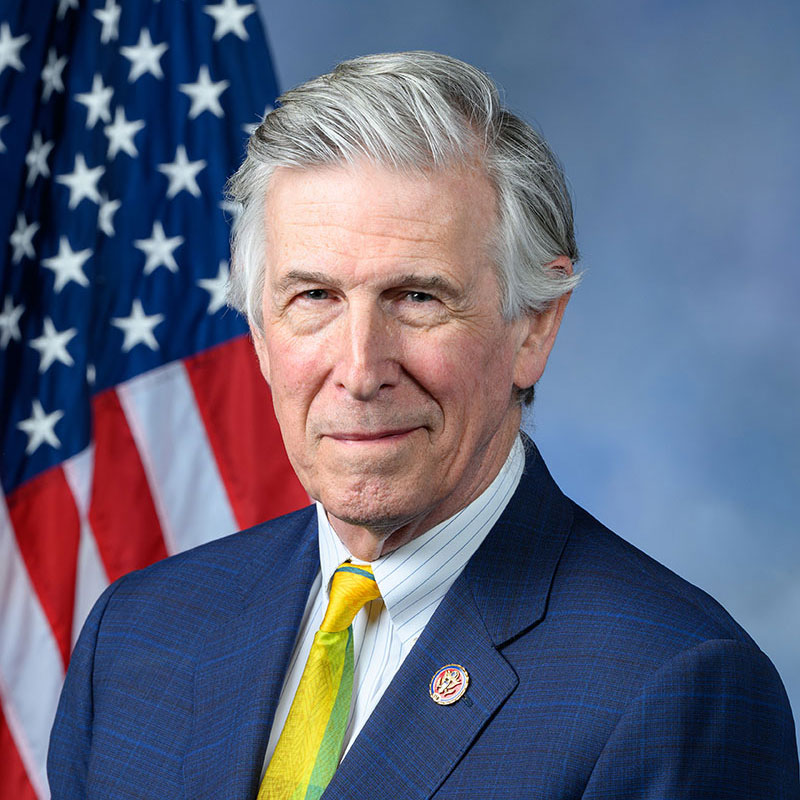

Senate Finance Committee Chairman Ron Wyden (D-Ore.) and Congressman Don Beyer (D-Va.-08), former U.S. ambassador to Switzerland, called on Attorney General Merrick Garland to crack down on Swiss banks enabling ongoing tax evasion by U.S. citizens and hold accountable individual bankers involved in these criminal schemes. The joint letter to Attorney General Garland follows the release of the Finance Committee’s two-year investigation into whether the Swiss bank Credit Suisse had violated the plea agreement it had reached with the Department of Justice in 2014 for its role in a criminal tax conspiracy involving thousands of American citizens. Wyden’s investigation uncovered major violations of that plea agreement, including ongoing, potentially criminal tax evasion, lax internal controls at Credit Suisse, and hundreds of millions of dollars hidden from U.S. authorities. No merger or bailout by the Swiss government should absolve any Swiss banks or bankers of criminal liability for facilitating tax evasion by U.S. persons. “Credit Suisse got a discount of $1.3 billion on the penalty it faced in 2014 for enabling tax evasion because its executives swore up and down they’d get out of the business of defrauding the United States. This Senate Finance Committee’s investigation shows Credit Suisse did not make good on that promise, and the bank’s pending acquisition by UBS should not wipe the slate clean,” Wyden and Beyer wrote. “We urge you to thoroughly investigate the facts presented in [the Finance Committee’s] report and send the message that violations of existing agreements with the Department will not be tolerated. The Department must also hold accountable any individual bankers who actively assisted wealthy Americans in filing false tax returns with the IRS. It is imperative for the fair administration of justice to demonstrate that financial institutions and bankers who knowingly engage in criminal activity are not above the law.” The full text of the letter is here. An online version of this release is here. |