Press Releases

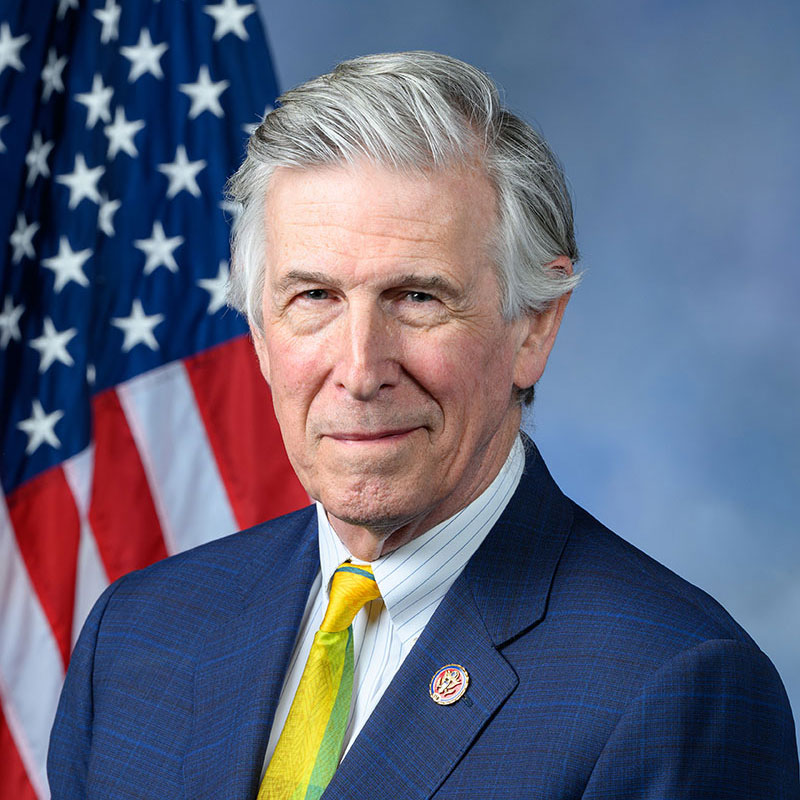

Bipartisan Leaders of the Joint Economic Committee Issue Requests to Federal Agencies on Efforts to Crack Down on Overseas Scam NetworksU.S. Congress Joint Economic Committee Chairman David Schweikert (R-AZ), Ranking Member Maggie Hassan (D-NH), Vice Chairman Eric Schmitt (R-MO), and Senior House Democrat Don Beyer (D-VA) today issued requests to federal agencies for information on their efforts to crack down on overseas scam networks that steal from Americans. Last year alone, Americans lost an estimated $10 billion from scams that originate in Southeast Asian compounds and often rely on U.S.-based technologies to identify and target victims. In letters to the U.S. Department of Justice, Department of Homeland Security, Department of the Treasury, Department of State, and Federal Trade Commission, the Members of Congress asked the agencies about their coordination across government and engagement with the private sector to disrupt overseas scam networks and protect Americans from scams. “Online scammers overseas routinely use technology or online platforms owned by American companies to defraud victims in the United States,” wrote Chairman Schweikert, Ranking Member Hassan, Vice Chairman Schmitt, and Senior House Democrat Beyer. “As the Administration acts to thwart bad actors and their corrosive attacks on our nation, whether in response to fentanyl trafficking or criminal cartel organizations, these scam compounds represent a necessary front.” The bipartisan request to federal agencies follows an alert issued by the four Joint Economic Committee leaders warning consumers about the heightened risk of travel scams during the holiday season. Read all the letters to federal agencies from the Joint Economic Committee members here, or their letter to the Department of the Treasury below: Dear Secretary Bessent, We are writing to request information about the ways in which the Department of the Treasury (Treasury) and U.S. technology companies are engaging to disrupt overseas scam networks and protect Americans from fraud and the foreign adversaries that enflame it, as well as the staff and other resources that the Treasury dedicates to this effort. Last year, overseas scam networks stole an estimated $10 billion from Americans through sophisticated criminal compounds that are based in Southeast Asia and are often staffed through the forced labor of trafficked workers. These scam compounds often rely on U.S.-based technologies—including social media and online dating platforms, artificial intelligence models, peer-to-peer payment applications, and satellite internet services—to identify, target, and defraud victims. New technology has contributed to the proliferation of these overseas compounds in recent years. Still, “U.S. efforts [to expose and deter this growing threat] remain fragmented and under-resourced,” according to the U.S.-China Economic and Security Review Commission (USCC). Online scammers overseas routinely use technology or online platforms owned by American companies to defraud victims in the United States. For instance, to begin a scam, criminals frequently initiate contact with potential victims on American-owned social media and online dating platforms. In the first half of 2023, at least half of individuals who reported financial losses from an online romance scam to the Federal Trade Commission (FTC) said that the scam began on a social media platform. Similarly, a co-owner of one popular peer-to-peer payment application notes that nearly half of the scams that its consumers report originate on social media. In addition, more than half of online dating users believe that they have encountered a scam. Scammers can also lend credibility to their communications through the use of artificial intelligence models developed and owned by American companies. In a February 2025 report, for example, one leading artificial intelligence company noted that scammers in Cambodia had used its technology to generate personalized English-language messages and sustain conversations with users on social media. Once they gain a victim’s trust, overseas scammers then solicit payments through American-owned peer-to-peer payment applications, where transfers are instant and, as the FTC notes, difficult to reverse. Finally, as an official from the U.S. Secret Service testified to Congress, scam compounds in Southeast Asia are increasingly turning to American-owned satellite internet services for the connectivity that often makes these online scams possible. Moreover, scam compounds in Southeast Asia reportedly operate with the tacit approval of Chinese state actors as part of a symbiotic relationship built on the exploitation of others. As described in the USCC report on these networks, criminal actors like Chinese crime boss Wan Kuok-Koi (“Broken Tooth”) have reinvented themselves into pro-CCP businesspeople as they rebuild their criminal networks. Broken Tooth operates a multi-billion-dollar scam network in China’s backyard near the Thailand–Myanmar border—reportedly laundering corrupt profits into the failing Chinese real estate sector and spreading CCP propaganda. As discussed above, scams perpetrated by Chinese criminal networks have devastated U.S. citizens. Last year, an 82-year-old Virginia man named Dennis took his own life after losing his life savings to a scam. As the Administration acts to thwart bad actors and their corrosive attacks on our nation—whether in response to fentanyl trafficking or criminal cartel organizations—these scam compounds represent a necessary front. The Government Accountability Office (GAO), for instance, has recommended that the Federal Bureau of Investigation lead the development of a government-wide strategy to combat scams that would address the “coordination of federal and business activities.” Industry representatives interviewed for the audit similarly called for what the GAO described as “a multisector approach, to include telecommunications and social media companies, as well as law enforcement to address fraudulently induced payments.” Officials from one of the world’s largest financial institutions also expressed support for public–private partnerships as part of a whole-of-government response. Similarly, the USCC has argued that improved coordination between the U.S. government and technology companies could be part of the solution to this problem. With no additional response, however, “criminal groups will likely continue exploiting platforms and services to target Americans with impunity.” To aid the Joint Economic Committee in understanding the Treasury’s current efforts and engagement with U.S. technology companies to combat overseas scam compounds and the actors that enable these scams, please provide responses to the following information requests: 1. Please identify all U.S. social media, online dating, artificial intelligence, peer-to-peer payment application, and satellite internet service companies with which the Treasury currently engages to disrupt activity from overseas scam compounds, and describe the frequency and nature of each engagement. 2. What specific tools or data do U.S. technology companies currently provide to the Treasury as part of these engagements? 3. Please describe any non-confidential coordination between the Treasury, U.S. technology companies, and other federal agencies that led to a federal enforcement action against an overseas scam compound or the foreign actors supporting the compound. 4. Please provide the Treasury’s total budget and current full-time equivalent staff dedicated to combating activity from overseas scam compounds. 5. What metrics, if any, does the Treasury use to evaluate the effectiveness of its efforts to combat activity from overseas scam compounds? If the Treasury plans to improve or develop these metrics, please describe how this will be achieved. 6. What dollar amount did the Treasury help save or return to victims of activity from overseas scam compounds in Fiscal Year 2024 and Fiscal Year 2025 to date as a result of its efforts to combat these scams? 7. Please describe the Treasury’s coordination with the following entities to combat activity from overseas scam compounds. For each entity, identify the Treasury offices involved; the scope and frequency of coordination; and any specific initiatives, joint operations, or information-sharing mechanisms: - a. Other U.S. federal agencies; - b. Foreign government or law enforcement agencies; and - c. International government or law enforcement agencies. 8. If the Treasury plans to improve its current coordination activities related to the issues mentioned above, please describe how this will be achieved. 9. What additional tools, if any, would help aid the Treasury in combating criminal scamming networks and the foreign actors supporting these networks? Please provide your responses as soon as possible, but in no event later than January 21, 2026. |