Press Releases

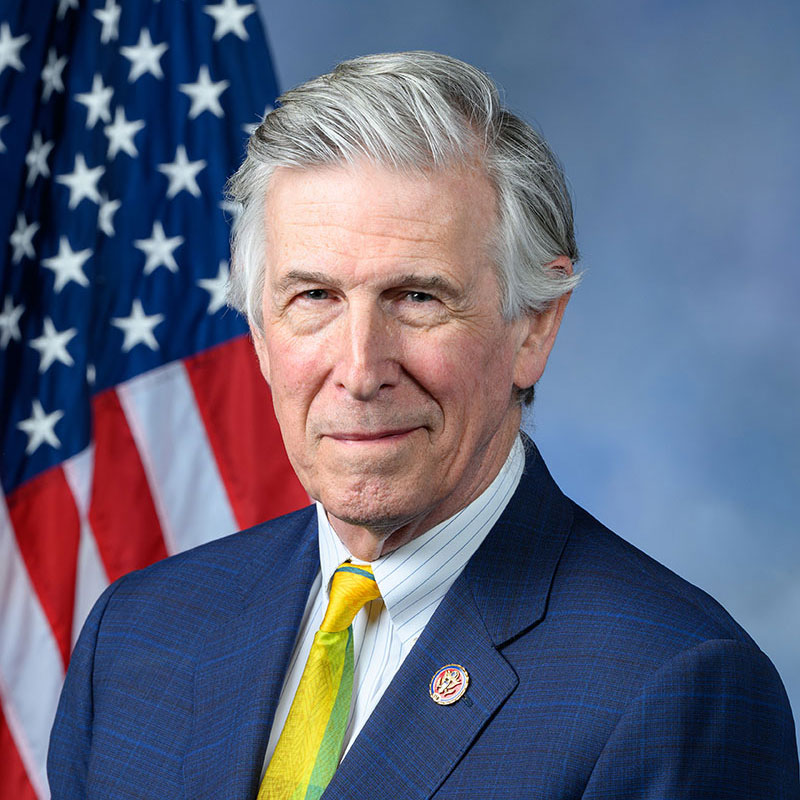

Van Hollen, Beyer Reintroduce Millionaires Surtax to Invest in Working FamiliesProposal Has Broad Support from American Public & a Wide Range of Advocacy, Economic, Labor, and Nonprofit OrganizationsToday, U.S. Senator Chris Van Hollen (D-Md.) and Congressman Don Beyer (D-Va.) reintroduced their Millionaires Surtax legislation to help close the gap between the wealthy and everyday Americans and raise significant revenue to make new investments that will grow the economy and protect working families. The Millionaires Surtax would apply an additional 10-percentage point tax to incomes above $2 million for married couples or above $1 million for individuals. It would apply equally to wages and salaries as well as to capital gains and other investment income. The bill, which is co-sponsored by Senators Sherrod Brown (D-Ohio), Amy Klobuchar (D-Minn.) and Jeff Merkley (D-Ore.), would increase federal revenue by $634 billion over 10 years and would only impact the richest 0.2 percent. It is a practical, mainstream approach to raising significant revenue that doesn’t require a major new tax overhaul – and avoids some of the common loopholes that the wealthy often try to exploit in order to game the system. “Right now, everyday Americans are shouldering our nation’s tax burdens, while many of the very richest skate by without paying their fair share. This is fundamentally backwards – and creates a growing opportunity gap that is harder and harder for American families to overcome. It’s time to right this wrong. The Millionaires Surtax is one step we can take to invest in policies that bring prosperity and opportunity to all Americans,” said Senator Van Hollen. “The Millionaires Surtax is a sensible plan to restore fairness to the tax code, fight rising inequality, and fund important priorities for the American people,” said Congressman Beyer. “The Republican tax cuts, as we feared, led to enormous benefits for the wealthy. Our legislation would require the wealthiest to pay their fair share and help prevent tax avoidance, which has been an enormous problem in enforcing our tax code. It would also benefit working people by providing revenue to help offset the cost of key legislative initiatives, for instance infrastructure investments. This is an idea whose time has come.” “There’s no reason why the richest people in the country should be paying less in taxes than the workers that they employ. Period,” said Senator Brown. “Corporate greed is fundamental to the Wall Street business model and until we change that, the richest people in the country are going to continue exploiting loopholes so they don’t have to pay their fair share.” According to polling by Hart Research Associates, the proposal has overwhelming support – 73 percent support a Millionaires Surtax, with 76 percent support from independents and moderates. Even a majority of Trump voters (57 percent) and Republicans (53 percent) favor the policy. The Millionaires Surtax legislation is supported by over 70 organizations, including: 20/20 Vision; Action Center on Race and the Economy; AFL-CIO; Alliance for Retired Americans; American Family Voices; American Federation of Government Employees (AFGE); American Federation of State, County and Municipal Employees (AFSCME); American Federation of Teachers, AFL-CIO; American Sustainable Business Council; Americans for Democratic Action (ADA); Americans for Tax Fairness; Bend the Arc Jewish Action; Blue Future; Campaign for America’s Future; Center for Popular Democracy; Center for Public Interest Law; Children’s Advocacy Institute; Coalition on Human Needs; Communications Workers of America (CWA); Congregation of Our Lady of Charity of the Good Shepherd, U.S. Provinces; CREDO Action; Daily Kos; Democracy Initiative; Demos; EPI Policy Center; Faith Action Network; First Focus Campaign for Children; Franciscan Action Network; Friends Committee on National Legislation; Friends of the Earth; Health Care for America Now; Indivisible; Institute for Policy Studies – Program on Inequality and the Common Good; International Association of Machinists & Aerospace Workers; International Brotherhood of Teamsters; International Federation of Professional and Technical Engineers (IFPTE); International Union, United Automobile Aerospace and Agricultural Workers of America (UAW); Jobs With Justice; Main Street Alliance; MomsRising; Movement Voter Project; MoveOn.org; National Advocacy Center of the Sisters of the Good Shepherd; National Association for Hispanic Elderly; National Council of Churches; National Disability Rights Network; National Domestic Workers Alliance; National Education Association; National Health Care for the Homeless Council; National Latino Farmers & Ranchers Trade Association; National Organization for Women; National Women’s Health Network; NETWORK Lobby for Catholic Social; JusticeOther98; Our Revolution; Patriotic Millionaires; People For the American Way; People’s Action; Progressive Democrats of America; Public Citizen; Responsible Wealth; RESULTS; RootsAction.org; Service Employees International Union; Strong Economy For All Coalition; Take on Wall Street; Tax March; United for a Fair Economy; United Steelworkers (USW); Voices for Progress; Working America; and Working Families Party. A letter of support signed by these organizations can be found here. The Millionaires Surtax legislation would:

“The Millionaires Surtax is very important legislation. It will ensure that the very wealthy start paying their fair share of taxes. It will generate a lot of revenue needed to support investments in affordable healthcare, infrastructure, eldercare, childcare, clean energy, and education. This will create millions of jobs and build an economy that works for all of us. And polling shows that the public strongly supports it,” said Frank Clemente, Executive Director, Americans for Tax Fairness. “It's become increasingly clear that the wealthiest people in America are extremely good at dodging taxes. If we want to fix that, any plan to tax rich Americans like me needs to be relatively easy to enact and hard to avoid. The Millionaires Surtax hits both targets. It's laser-focused on only the richest Americans, it's easy to understand, explain, and implement, and it would go a long way towards making the wealthiest Americans finally pay their fair share,” said Morris Pearl, Chair of the Patriotic Millionaires. |