Press Releases

Senators Warren and King, Representative Beyer Announce Legislation To Prevent The Biggest And Most Profitable Corporations From Paying Nothing In Federal TaxesReal Corporate Profits Tax Act would create a fairer tax system, strengthen the economy, and raise nearly $700 billion in revenue as America recovers from COVID-19 Pandemic Lawmakers are pushing to include the bill in reconciliation package as critical revenue raiser

Washington,

August 9, 2021

Tags:

Economy

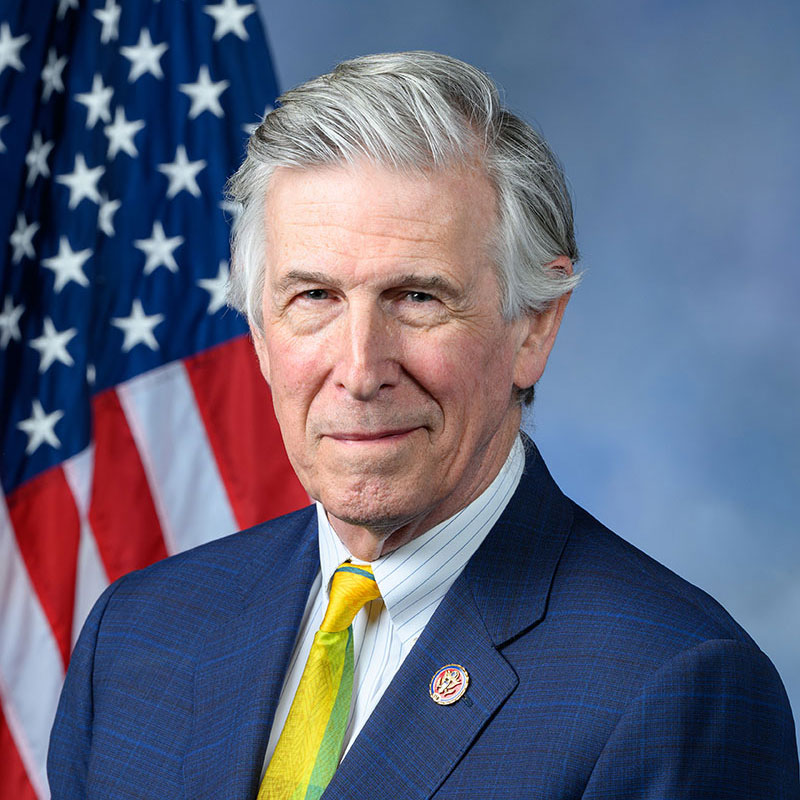

WASHINGTON, D.C. — Today, United States Senators Elizabeth Warren (D-Mass.) and Angus King (I-Maine), and United States Representative Don Beyer (D-Va.) announced bicameral legislation to ensure America’s largest corporations pay their fair share and prevent them from paying nothing in federal taxes. The Real Corporate Profits Tax Act of 2021 would create a fairer tax system and stronger economy by establishing a new tax on book income that would ensure the most profitable corporations contribute each year. The lawmakers are pushing to include the bill as a payfor in the reconciliation package. “Companies cannot be allowed to continue reporting billions in profits to shareholders and then turn around and pay nothing in taxes to the IRS. The American people know that's wrong. People in Congress know that's wrong. The President of the United States knows that's wrong. The Real Corporate Profits Tax Act would end corporate double dealing and ensure they pay their fair share so that we can raise essential revenue needed to invest in families and our economy,” said Senator Warren. “In 1965, corporations paid roughly 4% of the nation’s GDP in state and federal income tax. Today, that rate is only 1%,” said Senator King. “This massive decline has contributed to the nation’s rising debt and threatened basic public sector services Americans rely upon. Corporations should not be able to access America’s wealthy consumer market, talented labor pool, and other benefits without paying to support the conditions that make the U.S. the world’s premier place to do business – but many profitable, U.S.-based corporations pay zero federal corporate income tax. Our proposal is about simple fiscal sense and common fairness, creating a reasonable floor on tax payments to make sure profitable corporations with profits over $100 million pay their fair share.” “Many of the largest and most successful companies in the country pay zero or less in federal taxes, despite raking in record-breaking profits. It is time for these major corporations to pay their fair share by contributing to desperately needed investments in infrastructure, child care, and education that would benefit all Americans. The Real Corporate Profits Tax Act would ensure that corporations who take advantage of our infrastructure and workers trained in American schools at taxpayer expense pull their weight,” said Rep. Beyer. Currently, the U.S. tax code allows large corporations to pay little or no tax because they are able to exploit a host of loopholes, deductions, and exemptions to drive down their tax liability. While these companies report billions in “book income” on their financial statements, they often pay no income tax to the IRS and leave hardworking families holding the bag. For example, over the last three years, Amazon booked $45 billion in profits, including a record $20 billion last year as families struggled through the pandemic. But the effective tax rate it paid on those profits was just 4.3% – well below the 21% corporate tax rate. In fact, in 2018, Amazon didn't pay any federal income tax at all. Amazon isn't alone: between 2008 and 2015, 40% of our biggest companies paid zero or less in federal taxes in at least one year, even while they were telling their shareholders they were wildly profitable. This trend continued last year throughout the pandemic, with 55 companies that reported a cumulative total of $40 billion in pretax income received a net $3.5 billion back from the government in rebates. The Real Corporate Profits Tax Act would require companies to pay just $0.07 in taxes on every dollar above $100 million in book income that is reported to shareholders, and generate nearly $700 billion in revenue over ten years. The tax would be applied in addition to what companies owe under the regular corporate tax rules. Establishing the Real Corporate Profits Tax would not only put an end to profitable corporations getting away with paying zero (or less) in taxes, but it would also generate the revenue needed to invest in child care, education, infrastructure, and tackle the climate crisis– investments that make American companies more competitive and our economy more resilient. In the American Jobs Plan, President Biden proposed a minimum tax on the income large corporations use to report their profits to investors. Specifically, The Real Corporate Profits Tax Act would:

The Real Corporate Profits Tax Act is cosponsored by Senators Merkley, Markey, and Whitehouse. The Real Corporate Profits Tax Act is endorsed by Action Center on Race and the Economy, Data for Progress, Indivisible, Progressive Change Campaign Committee, Public Citizen, SEIU, Take on Wall Street. ### |