Press Releases

Beyer Applauds New Senate Corporate Minimum Tax Proposal

Washington,

October 26, 2021

Tags:

Economy

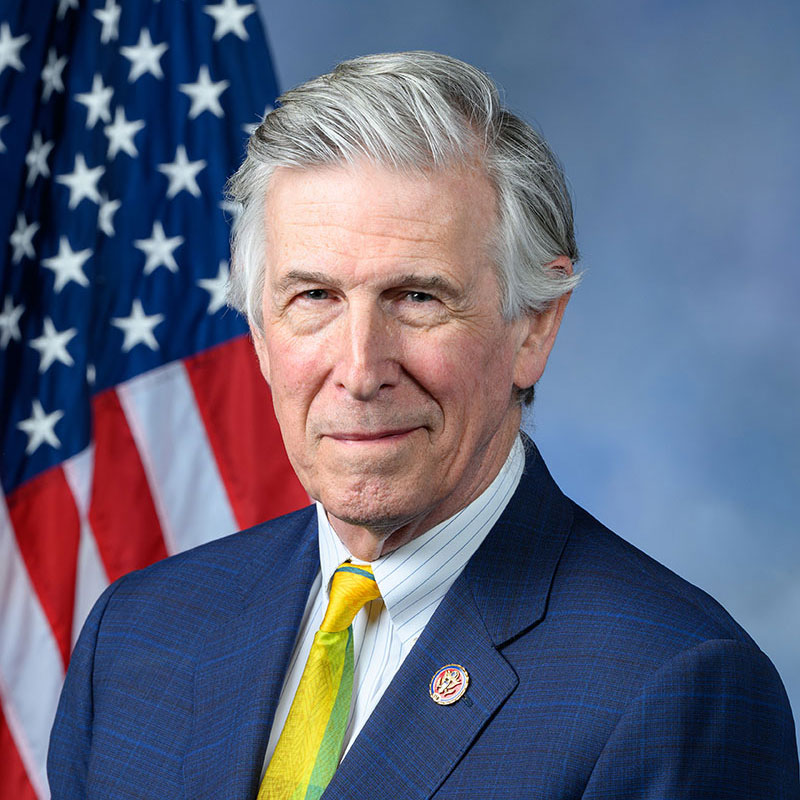

October 26, 2021 (Washington, D.C.) – Congressman Don Beyer (D-VA), who serves on the House Committee on Ways and Means, which has jurisdiction over tax policy, today welcomed the announcement of a new corporate minimum tax framework in the U.S. Senate. Beyer is the House sponsor of the Real Corporate Profits Tax Act, introduced in the Senate by Sens. Elizabeth Warren (D-MA) and Angus King (I-ME). Warren and King today unveiled their new framework for a corporate minimum tax in partnership with Senate Finance Chair Ron Wyden (D-OR). “I fully support this proposal by Senators Warren, King, and Wyden, and will work to help educate my colleagues in the House about the details and benefits of a corporate minimum tax as we look to finalize details on a framework for the Build Back Better Act,” said Rep. Beyer. “Despite raking in record-breaking profits, many of our country’s largest corporations pay zero or less in federal taxes, and it is time they paid their fair share. A corporate minimum tax would make the tax code fairer and raise significant revenue on the scale required to help pay for the costs of investments we all hope to pass as part of the President’s agenda. This proposal is a big step forward on the revenue portions of that legislation, and I commend my colleagues for their work.” Details of the new Warren-King-Wyden proposal for a corporate minimum tax are available here. The framework was swiftly endorsed by Sen. Kyrsten Sinema (D-AZ), and Sen. Joe Manchin has repeatedly expressed support for the concept. |